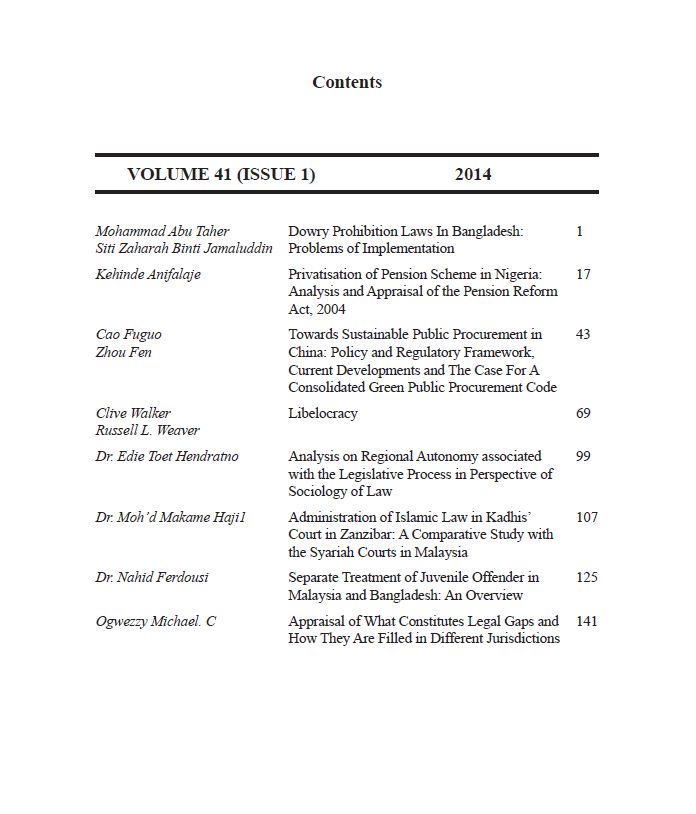

Privatisation of Pension Scheme in Nigeria: Analysis and Appraisal of the Pension Reform Act, 2004

Keywords:

pension, reform, act, PRA, 2004, Nigeria, gratuity, gratuities, pensions, retired, public, servantsAbstract

The enactment of the Pension Reform Act, (PRA) 2004 is evidence of a great change in pension administration and management in Nigeria considering the abysmal failure of the old pension scheme to provide retired public servants pensions and gratuities as and when due. The PRA, 2004 displaces to a large extent the Pay-As-You-Go system of the repealed Pension Act, 1974 and enthrones a new pension regime described as the defined-contribution scheme which entails the transformation of the financial and administrative structure of the pension system. The central feature of the new system is the establishment of individual capitalization fund and the consignment of pension fund assets to private-sector organizations for greater efficiency and maximal return on investment under strict regulation and supervision of the regulatory authorities. This paper focuses on an analysis of the new pension law in Nigeria. It also examines the extent of the privatisation of the pension scheme in Nigeria and the economic and social implications of privatisation of pension schemes in general. The paper also highlights defects in the law and proffer suitable reform proposals. The paper concludes with a discussion on the level of socio-economic development in the country, especially the level of poverty and argues for the establishment of a social-assistance-based national old-age pension that would provide means-tested benefits to the elderly poor population.